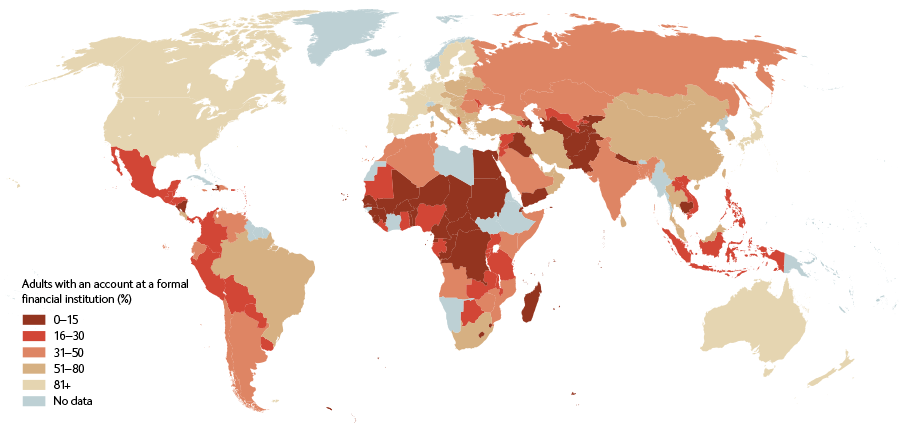

Financial inclusion – measured by bankability and account penetration – remains very low in Sub-Saharan Africa, Central, South and South-East Asia. It has been argued by the World Bank’s “Consultative Group to Assist the Poor” (CGAP) that this is partially driven by self-exclusion by observant Muslims from conventional interest bearing financial products.

According to a 2008 CGAP survey, Islamic microfinance accounts for about 0.5% of global microfinance provision. At the same time, the worth of worldwide Islamic financial assets have leapt from half a million dollars in the 1970s to an estimated US$1.5 trillion today (Global Islamic Finance Report 2016). Ernst & Young (2014) estimates that global Islamic assets will top US$3.4 trillion by 2018. A large dormant demand for Islamic financial products can be assumed, and GEMicro is ready to bridge this gap between supply and demand in emerging markets.

GEMicro currently works with partners in the following markets: